Actuary /

Fap3-2

Module 3: Risk in Actuarial Problems

Section 2: Why Define the Problem

Back to list of modules

Objectives

- Explain how “Define the Problem” fits within the context of the Control Cycle.

- Given an example of a financial security system failure, describe how better problem definition could have been employed to help avoid the crisis.

- Recognize the significance of successfully defining problems.

- Identify risks related to financial security systems.

Defining the problem

- When developing an actuarial solution, actuaries must fully understand the nature of the problem or run the risk of:

- Failing to meet personal or corporate objectives.

- Losing time as a result of having to repeat tasks or perform new tasks.

- Incurring financial losses as a result of poorly defined risks.

- Losing intangibles such as happiness, integrity, professional reputation or personal satisfaction.

- Losing opportunities for financial or personal gain.

- Read Recapping the Control Cycle (m3s2-01_RecapControlCycle.pdf) for a brief review.

- Example: In the United States in the early 1980s, there was a series of failures among savings and loan (S&L) institutions. In the late 1970s, S&Ls were stable institutions that operated in a stable environment. What happened in the early 1980s was that in a short period of time, the S&L environment underwent a series of changes that significantly increased their risks. Internal management of the S&Ls did not keep pace with the environmental changes. Further, external regulation of the S&Ls was not well-suited to the modern industry. The result was a crisis. The first reading (m3s2-02_SnL_Time.090905.pdf) a 1989 Time magazine article written shortly after a "bailout" plan was presented by the administration of George H. W. Bush, focuses on the issues from a political standpoint. The next reading (m3s2-03_FDIC - Savings and Loan Crisis.pdf) is a chapter from an online historical analysis from the Federal Deposit Insurance Corporation (FDIC).

- All of the following factors contributed to the savings and loan (S&L) crisis:

- Booming and busting economies in parts of the country

- Congress increasing FSLIC liability from $40,000 to $100,000

- End of the “3-6-3” practice for thrifts in the 1980s

- Steeply increasing and historically high interest rates

- Allowing S&Ls to pay more interest on deposits while not charging more on loans (it was believed this would keep them competitive).

- Record high interest rates followed almost immediately.

- Governmental belief that the insolvencies were only "on paper" and many in the government felt that the S&Ls would return to solvency once interest rates dropped.

- Legislation, such as DIDMCA, passed to remedy the situation actually worsened the situation; DIDMCA reduced net worth requirements and increased federal deposit insurance to $100,000.

- A 1982 change in regulations allowed S&Ls to expand into new markets that had very different risk profiles than the traditional S&L residential mortgage market.

- Liberal powers afforded the states rights to relax S&L regulations

- Slow action on the part of regulators allowed an initial problem to snowball into a wide spread crisis.

- Bailing out the savings and loan (S&L) industry would have cost an estimated $25 billion in early 1983. The FSLIC (Federal Savings and Loan Insurance Corporation) had only $6.3 billion in reserve, about ¼ of the amount needed, and could not bailout the insolvent S&Ls.

- Examiners worked for the Office of Examination and Supervision of the Bank Board (OES). Supervisory personnel resided within the Federal Home Loan Bank System and essentially reported to the president of the local FHLB. So no agency had a single, direct line of responsibility for a troubled institution. This allowed problems to fester.

- Attending to the following will help you to define the problem successfully.

- Know the business.

- Assess the situation.

- Think ahead.

- Talk to the right people.

- Ask open-ended questions.

- Listen actively and carefully.

- Involve the key stakeholders.

- Focus on the relevant issues.

- Confirm the issues.

- Make adjustments as necessary.

- Respond to real needs.

- Identify and analyze risks.

- Subprime mortgages are loans issued to high-risk borrowers. From the mid-1990s to 2005, the subprime mortgage market in the United States grew very quickly, from about five percent of residential mortgages to about 20 percent of residential mortgages. The resulting subprime mortgages were then collateralized and sold “in block” as low risk mortgage bond investments to third parties around the world. In 2006, the subprime mortgage market collapsed, and the effects of this collapse continue to be felt in the broader financial markets in the United States and other countries. Read “The Subprime Meltdown: A Primer” (m3s2-05_Subprime_Meltdown.pdf) from NERA Economic Consulting.

- The real problem in the subprime mortgage crisis was inappropriate management of credit risk. From purchasers of individual mortgages, to those responsible for creating and selling the tranched securities, to the purchasers of the mortgage bonds, no one defined their level of risk tolerance, nor did they take appropriate measures to price or manage the risks. Buyers of the mortgage bonds could not determine appropriate risk premiums because they were often unaware that they were essentially buying “junk” mortgages. They were unprepared for the lack of collateral supporting their mortgage bonds. We manage credit risk through underwriting (i.e., “selection of risk”) and pricing. Read the editorial Actuarial Aspects of the Recent Financial Market Crisis (m3s2-06_SubPrimeEditorial.pdf) from the October/November 2007 issue of The Actuary magazine.

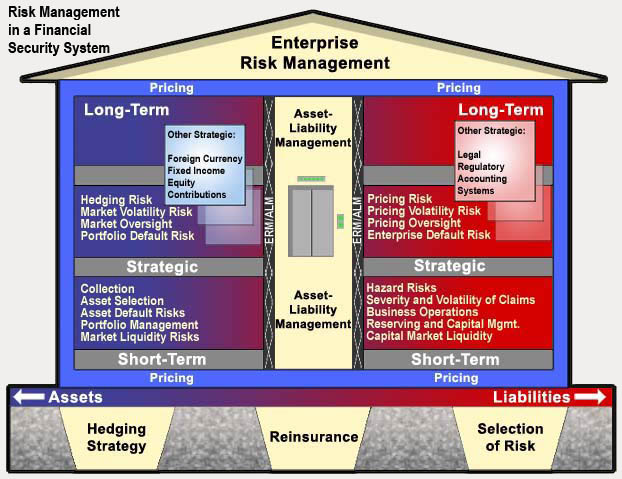

- The graphic "Risk House" provides a complete picture of the risks inherent in the management of a financial security system. Note that asset liability management is at the center of the model. Read "Overview of Risks Related to Financial Security Systems" (m3s2-07_fss_risk_graphic.pdf)

- Risk Pedestals: "Selection" can be thought of as risk avoidance; "reinsurance" represents risk transfer strategies; and "hedging" represents risk reduction strategies.

- The practice of enterprise risk management (ERM) has been developing over the past several years. Read Chapter 1 in Corporate Value of Enterprise Risk Management (2011), to learn about the evolution of ERM.

- The following have influenced the development of ERM over the past few years: Basel accords, corporate accounting fraud, rating agency scrutiny, and financial crisis.

- In the following reading from Financial Enterprise Risk Management, Sweeting presents several case studies to illustrate issues faced by organizations and the causes of a range of risk management failures. Read Chapter 20, Case Studies (Sweeting_Ch20.pdf), from Financial Enterprise Risk Management. Ideas from the reading:

- Basel I gave banks an incentive to convert mortgage credit risk to market risk by securitizing loans (mortgage-backed securities).

- Banks were exposed to housing market risks directly through conventional mortgages and indirectly though mortgage-backed securities. Further, banks often sold and bought mortgage-backed securities at the same time. Generally, bank management did not understand the concentration of risk.

- Long Term Capital Management used models extensively, not only to provide information to management, but also to make decisions. The models, however, were flawed and underestimated the likelihood of large, adverse movements.

- In the following, industry experts share examples of designing a solution based on an initial request that, in hindsight, was ill-defined and not clarified or verified. Read the following examples where actuarial work focused on an initial problem stated rather than the actual problem.

- Example 1: U.S. Social Security - m3s2-09_SS_Exp1.090905.pdf

- Example 2: Reducing Employer Health Care Costs - m3s2-10_Health_Exp2.090905.pdf

- Example 3: Life Insurance - m3s2-11_Life_Exp3.090905.pdf

- Bottom line: Eighty percent of all problem-solving efforts are hampered by poor problem definition. Finding an effective solution is difficult if the problem is not well defined.